5th Floor, West Tower, World Financial Centre

1 Dong San Huan Middle Road

Chaoyang District, Beijing 100020, China

Tel: +86 10 5081 5880

June 28, 2024

SAIF Delegation Attends Conference on Shanghai Pilot Free Trade Zone

On June 21st, a delegation from the Shanghai Advanced Institute of Finance (SAIF) at Shanghai Jiao Tong University (SJTU) attended the Conference on the High-Level Opening-up of China (Shanghai) Pilot Free Trade Zone Lin-gang Special Area.

June 27, 2024

SAIF Provides Academic Support for the 15th Lujiazui Forum

The 15th Lujiazui Forum took place in Shanghai on June 19th and 20th. As the chief academic supporter, the Shanghai Advanced Institute of Finance (SAIF) provided extensive academic support.

June 26, 2024

IMF Chief Economist Visits SAIF, Strengthening Cooperation in Financial Research ...

On June 21st, Professor Pierre-Olivier Gourinchas, Chief Economist and Director of the Research Department at the International Monetary Fund (IMF), and his delegation visited the Shanghai Advanced Institute of Finance (SAIF) at Shanghai Jiao Tong Univers

June 18, 2024

SAIF Achieves a New Record High: No.8 Globally in the Financial Times Masters in ...

On June 17th, the Shanghai Advanced Institute of Finance (SAIF) at Shanghai Jiao Tong University celebrated a remarkable milestone as its Master of Finance (MF) Program was ranked No.8 globally by the Financial Times Masters in Finance 2024 Ranking. This

May 27, 2024

2023 China Residents Financial Literacy Report Released

On April 16th, the Launch Event of the 2023 China Residents Financial Literacy Report (the Report) was held in Shenzhen. The Report—jointly released by the Shanghai Advanced Institute of Finance (SAIF) of Shanghai Jiao Tong University (SJTU), Charles Schw

May 26, 2024

Deputy Dean of Imperial College Business School Visits SAIF

On April 20th, Leila Guerra, Deputy Dean of Imperial College Business School (ICBS), visited the Shanghai Advanced Institute of Finance (SAIF) at Shanghai Jiao Tong University. The SAIF attendees at the meeting included Deputy Dean of Academic Affairs

May 25, 2024

2024 CGMA Global Finance and Accounting Talent Summit Convened

The 2024 CGMA Global Finance and Accounting Talent Summit was convened on April 11th in Pudong, Shanghai. The summit was jointly hosted by the Shanghai Advanced Institute of Finance (SAIF) of Shanghai Jiao Tong University (SJTU), the Association of Inter

May 24, 2024

Delegation from the Universitas Indonesia Visits SAIF

On April 19th, a delegation from the Faculty of Economics and Business, Universitas Indonesia (UI FEB), led by Dean Teguh Dartanto, visited the Shanghai Advanced Institute of Finance (SAIF) at Shanghai Jiao Tong University. The SAIF attendees at the meeti

April 27, 2024

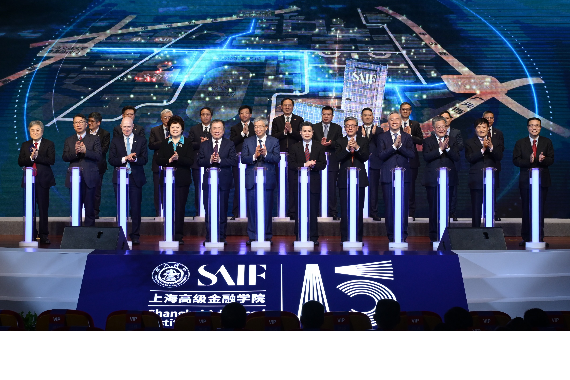

The 15th Anniversary Celebration of the Shanghai Advanced Institute of Finance

On April 20th, the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University commemorated its 15th anniversary with a conference held at the Xuhui Campus. Nearly 700 distinguished guests convened, including representatives from government en

April 26, 2024

SAIF Professors Recognized as 2023 Highly Cited Chinese Researchers by Elsevier

On March 27th, Elsevier, a prestigious global academic publisher, unveiled the "2023 Highly Cited Chinese Researchers" list. Three professors from the Shanghai Advanced Institute of Finance (SAIF) at Shanghai Jiao Tong University (SJTU) were honored as Hi

211 West Huaihai Road

Shanghai 200030, China

Tel: +86 21 6293 3500

9th Floor, Building T6, Hongqiao Hui

990 Shenchang Road

Shanghai 201106, China

3rd Floor, Building D, Chenfeng Building

800 Tongpu Road

Shanghai 200062, China

5th Floor, West Tower, World Financial Centre

1 Dong San Huan Middle Road

Chaoyang District, Beijing 100020, China

Tel: +86 10 5081 5880

1203 Tower 7, One Shenzhen Bay

Nanshan District, Shenzhen 518000, China

Tel: +86 755 8663 8815

© Shanghai Advanced Institute of Finance All Rights Reserved.

Top