5th Floor, West Tower, World Financial Centre

1 Dong San Huan Middle Road

Chaoyang District, Beijing 100020, China

Tel: +86 10 5081 5880

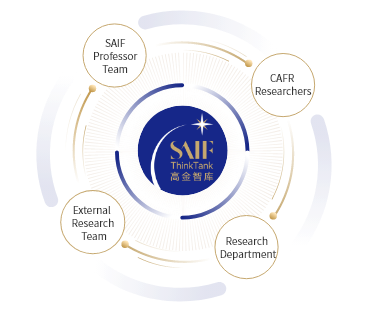

SAIF ThinkTank is the research platform of Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University. Leveraging SAIF's research strengths and collaborating with domestic and international experts and scholars, it focuses on overarching, forward-looking, and strategic matters integral to Shanghai's growth as an international financial center. Aligned with national economic and financial strategies and policy frameworks and adhering to the objective of cultivate a robust financial system, SAIF ThinkTank conducts in-depth research in critical areas including sci-tech innovation finance, sustainable finance, and digital finance.

SAIF ThinkTank, as the research platform of SAIF, leverages the institute's robust research capabilities while engaging domestic and international experts and scholars. It cultivates young research talent through initiatives. An initial cohort of researchers was developed to focus on policy and strategic analysis, establishing a sustainable, multi-tiered research framework. This enables SAIF ThinkTank to effectively address research directives from governmental entities and respond to specialized research needs.

Embarking on the Path of Sustainable Development The 2025 Shanghai ESG Report

Following the inaugural The Implementation of Sustainable Development—The 2024 Shanghai ESG Development Report, which systematically presented a panoramic view of Shanghai's ESG ecosystem, this year’s edition of the report adheres to practice-driven and problem-oriented principles and offers a more in-depth and focused introduction to the ESG development practices of various entities in Shanghai. The report not only documents new developments over the past year but also strives to identify future challenges faced by these entities, offer structured and actionable policy recommendations, and provide an analysis of progression path that could be referenced for the sustainable development in Shanghai and across China.

[SAIF ThinkTank Key Report] Issue 80 - Tracking Study on Macroeconomic and Financial Policies and Situation in Hong Kong, China, 2024

Amid the wave of global economic integration, Hong Kong, China has emerged as a vital hub for capital flows and financial innovation, leveraging its unique geographical location, highly developed financial markets, and mature regulatory framework. However, as the global economic landscape continues to evolve, factors such as trade frictions, geopolitical risks, and policy adjustments in major economies present new challenges and opportunities for Hong Kong's macroeconomy and financial markets.

Solving the Puzzle of the Personal Loans Industry via Law and Fintech

Shanghai International Financial Center Construction Series Report 2022

211 West Huaihai Road

Shanghai 200030, China

Tel: +86 21 6293 3500

9th Floor, Building T6, Hongqiao Hui

990 Shenchang Road

Shanghai 201106, China

3rd Floor, Building D, Chenfeng Building

800 Tongpu Road

Shanghai 200062, China

5th Floor, West Tower, World Financial Centre

1 Dong San Huan Middle Road

Chaoyang District, Beijing 100020, China

Tel: +86 10 5081 5880

1203 Tower 7, One Shenzhen Bay

Nanshan District, Shenzhen 518000, China

Tel: +86 755 8663 8815

© Shanghai Advanced Institute of Finance All Rights Reserved.

Top